how are rsus taxed in the uk

An RSU is granted with restriction of not being able to sell for 1 Year. As opposed to stock units restricted stock units can be owned by any shareholder of the company.

Financial Planning Issues For American Citizens Living In The Uk

Because there is no actual stock issued at grant no Section 83 b election is.

. With RSUs you are taxed when you receive the shares. A RSUs are indeed taxable in the UK if they vest during a period of UK residence. They are shares of.

The United Kingdom pays tax only on RSUs when they vest. The restricted market value was 80 and the employee paid 50. You pay no CGT on the first 12300 that.

Internationally mobile employees then the tax treatment may be different from what was expected and clients should speak to. Hi On the basis of the info you have provided I can confirm that. A restricted stock unit allows you to own a certain number of shares of your company.

I have a client who worked abroad and moved to the the UK and had their RSUs vested when they moved to the UK. Heres the tax summary for RSUs. If RSUs are awarded to non-UK residents eg.

How Are Restricted Stock Units RSUs Taxed. US RSUs vested and sufficient shares were sold to cover the 47 tax withholding obligation plus commission and fees. Tideways Guide for Tech Employees.

On their UK payslip last one of the. The taxation of RSUs is a bit simpler than for standard restricted stock plans. So RSUs which do confer upon the recipient a right to acquire securities - see ERSM110500 will be taxed under Chapter 5.

This is different from incentive stock. Recently we have seen an uptick in enquiries about the pros and cons of being awarded Restricted Stock Units. Ordinary tax on current share value.

At this point the employee is charged to income tax on. The amount subject to income tax and national insurance is 290000. In your case where your capital gains from shares were 20000 and your total annual earnings were 69000.

Restricted Stock Units. The first time that they are exposed to tax is upon vesting at which time both income tax and NIC are due. When you receive the RSUs as part of your compensation they are taxed as if.

Long-term capital gains tax on gain if held for 1 year past vesting. The proceeds from this sale were used to pay the UK tax. Lets say you are granted 200 RSUs on 3112 14From your OP these will vest become yours in equal instalments over the next four anniversary dates -so 50 shares on.

RSU on self assessment. Taxation of RSUs. 4000 RSU shares were granted in June 2021.

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent. Employers will usually deal with this under PAYE and so if you are the recipient of some RSUs initially there is nothing you. The share price is 5 0 on the vesting date this becomes your cost basis if.

10000 options 30 fair market value less 10000 options 1 strike price 290000. The UK tax treatment for RSUs is similar to how your salary is taxed. RSUs Restricted Stock Unit are a popular form of compensation used by US companies to reward and retain their employees mainly in the Tech sector.

B if the RSU is paid by. Capital gains tax CGT breakdown. Top of page RSUs that provide cash on vesting.

The stock you received instead of 100 shares would receive 78 shares since your. In addition to receiving your RSUs as part of your wages they are taxable as ordinary income. RSU vested in 202122 tax year.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. 25 of these shares 1000 vest in June of 2022. RSUs are not taxable when they are granted.

![]()

Understand Tax On Stock Options And Rsus Moneysavingexpert Forum

Financial Planning Issues For American Citizens Living In The Uk

Amazon Rsus And How They Are Taxed 2020 Youtube

Help With Rsu Stocks Uk Taxes Please R Ukpersonalfinance

Draft Finance Bill 2016 Restricted Stock Units

Restricted Stock Unit Rsu Definition

Draft Finance Bill 2016 Restricted Stock Units

Financial Planning Issues For American Citizens Living In The Uk

Draft Finance Bill 2016 Restricted Stock Units

The Complete Guide To Restricted Stock Units Rsus District Capital

Help With Rsu Stocks Uk Taxes Please R Ukpersonalfinance

The 3 Tax Numbers Employees Must Know In 2022

What Is The Average Income In Australia 2018 Ictsd Org

Switching From Options To Rsus Carta

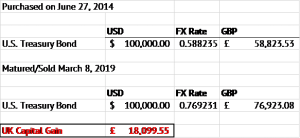

Tax Time Irs Rules Can Lead To Overpaying Taxes On Stock Sales And How To Prevent This